Alternative Hydrocolloids Market is Predicted to Reach USD 4,467.6 Million by 2036 Amid Clean-Label and Supply Shifts

UK demand for alternative hydrocolloids grows at 5.6% CAGR, driven by reformulation, retailer standards, clean labels, and texture stability needs.

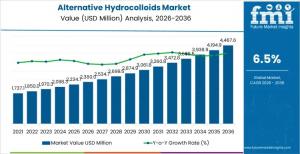

NEWARK, DE, UNITED STATES, January 19, 2026 /EINPresswire.com/ -- The global alternative hydrocolloids market is projected to expand from USD 2,380.0 million in 2026 to USD 4,467.6 million by 2036, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. Growth is being shaped by food and beverage manufacturers actively substituting conventional hydrocolloids such as carrageenan, guar gum, and locust bean gum due to persistent supply volatility, pricing instability, and formulation limitations across key product categories.

According to the latest industry outlook, alternative hydrocolloids including tara gum, konjac glucomannan, cellulose-based systems, and seaweed-derived alternatives are increasingly specified to deliver viscosity control, gelling behavior, and water-binding functionality. These ingredients are being deployed across dairy alternatives, ready meals, bakery and confectionery products, plant-based foods, and beverages, where traditional stabilizers face availability risks or clean-label constraints.

Unlock Growth Potential and Explore Market Opportunities With Our Comprehensive Industry Overview. Request Your Sample Now

https://www.futuremarketinsights.com/reports/sample/rep-gb-31456

Market Context: Why Alternative Hydrocolloids Are Gaining Share

Food and beverage developers are accelerating adoption of alternative hydrocolloids to address multiple converging pressures. Clean-label expectations have intensified scrutiny of ingredient lists, while seasonal variability in raw material supply has exposed formulation risk tied to legacy gums. At the same time, product reformulation—linked to plant-based positioning, protein fortification, and sugar or fat reduction—has increased texture complexity, reinforcing the need for predictable and application-specific structuring agents.

Alternative hydrocolloids derived from seeds, fibers, seaweed, and microbial fermentation offer functional transparency alongside performance attributes that support modern processing conditions. Ingredient selection, however, remains matrix-specific rather than a one-to-one replacement strategy, as hydration behavior, shear tolerance, and interactions with proteins and starches vary widely by application.

Quick Stats: Alternative Hydrocolloids Market Snapshot

• Market Value (2026): USD 2,380.0 million

• Forecast Value (2036): USD 4,467.6 million

• CAGR (2026–2036): 6.5%

• Leading Category by Demand Share: Tara gum

• Fastest-Growing Countries: India, China, Brazil, USA, UK

• Major Demand Contributors: Cargill, Ingredion, ADM, Tate & Lyle, CP Kelco

Segmentation Insights: How Demand Is Distributed

By Hydrocolloid Category

Tara gum leads global demand with a 26.0% share, reflecting functional familiarity and reliable performance in dairy alternatives and prepared foods. Konjac glucomannan follows at 22.0%, valued for high viscosity at low inclusion rates and strong water-binding efficiency. Locust bean gum alternatives (18.0%) and cellulose-based hydrocolloids (17.0%) are increasingly used to mitigate supply risk while maintaining neutral sensory profiles. Seaweed-derived alternatives (11.0%) and other niche systems address specific gelation and clean sourcing requirements.

Key points:

• Tara gum dominates due to versatility and process tolerance

• Konjac delivers viscosity efficiency at low dosage

• Cellulose systems support neutral texture control

By Functional Role

• Thickening and viscosity control: 38.0%

• Texture replacement and structuring: 27.0%

• Water binding and moisture control: 21.0%

• Stabilization and suspension: 14.0%

This distribution reflects prioritization of rheology control and moisture management in reformulated products exposed to thermal cycling, freeze–thaw stress, and extended shelf life requirements.

By Application

• Dairy and dairy alternatives: 29.0%

• Processed and ready meals: 24.0%

• Bakery and confectionery: 19.0%

• Plant-based foods: 17.0%

• Beverages: 11.0%

Dairy alternatives rely on protein-compatible systems to manage phase separation, while ready meals specify hydrocolloids that retain structure during reheating. Beverage manufacturers focus on suspension stability without excessive haze.

Regional Outlook: Growth Driven by Formulation Resilience

Global demand is rising as manufacturers diversify away from traditional gums to improve sourcing flexibility and formulation resilience.

Country-level CAGR highlights:

• India: 7.6%

• China: 7.3%

• Brazil: 6.9%

• United States: 5.8%

• United Kingdom: 5.6%

In India and China, growth is supported by substitution of imported gums and expansion of locally sourced or fermentation-derived alternatives. In Brazil, climate-driven stability challenges accelerate adoption, while in the U.S. and UK, clean-label reformulation and supply chain diversification remain primary drivers rather than category volume growth.

Competitive Landscape: Functional Performance Over Promotion

The competitive environment is defined by application support, supply reliability, and functional equivalence rather than brand-driven promotion. Leading suppliers—including Cargill, Ingredion, ADM, Tate & Lyle, and CP Kelco—compete by offering hydrocolloid systems that balance viscosity build, gel strength, and stability under heat, shear, and pH stress. Technical collaboration during reformulation and scale-up has become a key differentiator as manufacturers validate sensory performance across shelf life.

Outlook: Matrix-Specific Adoption Shapes Market Trajectory

Looking ahead, the alternative hydrocolloids market is expected to expand through targeted, application-specific integration rather than wholesale replacement of traditional gums. Regulatory definitions, functional boundaries under extreme processing conditions, and cost considerations will continue to influence scalability. As reformulation cycles intensify across dairy alternatives, ready meals, beverages, and plant-based foods, alternative hydrocolloids are positioned as strategic tools for texture management, stability, and sourcing resilience through 2036.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Related Reports Insights from Future Market Insights (FMI)

Plant-based Snacks Market https://www.futuremarketinsights.com/reports/plant-based-snacks-market

Non-Dairy Yogurt Market https://www.futuremarketinsights.com/reports/non-dairy-yogurt-market

Diindolylmethane Market https://www.futuremarketinsights.com/reports/diindolylmethane-market

Palm Mid-Fraction Market https://www.futuremarketinsights.com/reports/palm-mid-fraction-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.