Automotive Interior Leather Market Set for Growth with Sustainability, Comfort, and Innovation at Forefront

Automotive Interior Leather Market Outlook (2025–2035): Demand for PU leather, aftermarket customization, and eco-friendly materials fuels consistent expansion

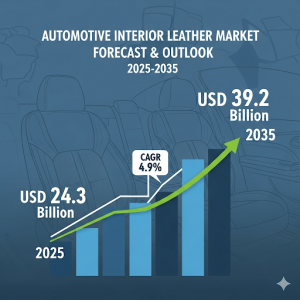

NEWARK, DE, UNITED STATES, September 3, 2025 /EINPresswire.com/ -- The automotive interior leather market is entering a decade of steady growth, offering manufacturers and suppliers new opportunities to align with shifting consumer preferences and sustainability standards. Valued at USD 24.3 billion in 2025, the market is projected to expand to USD 39.2 billion by 2035, advancing at a CAGR of 4.9%. This expansion reflects growing demand for premium, comfortable, and eco-friendly vehicle interiors, alongside the rising adoption of synthetic and PU leather alternatives.

Market Momentum Driven by Changing Consumer Expectations

By 2030, the automotive interior leather market is forecast to reach USD 31.8 billion, representing steady growth in the first half of the forecast period before accelerating towards 2035. The industry will add USD 14.9 billion in absolute dollar growth between 2025 and 2035, with opportunities concentrated in luxury vehicles, electric mobility, and aftermarket customization.

The seats and center stack segment, which accounts for 34.3% share in 2025, continues to anchor demand, as these highly interactive areas define cabin comfort and luxury perception. North America leads with a 40% share, reflecting strong luxury and premium vehicle production, while Asia Pacific demonstrates the fastest growth, with China and India driving capacity expansions and eco-friendly adoption.

PU Leather Leads the Market with 55% Share in 2025

Among material types, PU leather emerges as the most lucrative segment, commanding 55% of the market in 2025. Manufacturers favor PU leather for its cost-effectiveness, sustainability, and durability, making it an attractive alternative to genuine and PVC leather. Its aesthetic appeal, coupled with eco-friendly characteristics, positions PU leather as the material of choice across passenger cars, commercial vehicles, and increasingly in electric vehicle interiors.

The aftermarket segment also holds strong potential, capturing 42% share in 2025. With growing consumer demand for personalization and refurbishment, aftermarket channels provide flexible, cost-effective solutions for upgrading interiors. Availability of high-quality synthetic leathers and eco-friendly finishes further enhances aftermarket opportunities for manufacturers.

Why the Market is Growing

Manufacturers are navigating three core growth drivers shaping demand:

1. Premiumization of Vehicle Interiors – Rising disposable incomes and cultural preference for luxury interiors are accelerating demand for premium automotive leather.

2. Sustainability and Eco-Friendly Alternatives – Advanced tanning methods, bio-based leathers, and antimicrobial finishes are helping manufacturers meet environmental and health-conscious demands.

3. Technological Advancements in Processing – Innovations in thermo-cool, antibacterial, and recyclable leather materials are expanding applications across OEM and aftermarket channels.

The push for clean-label, recyclable, and synthetic leathers is particularly strong in electric and hybrid vehicles, where interior comfort must align with sustainability values.

Country-Level Growth Dynamics

Growth opportunities vary significantly across regions, providing manufacturers with targeted strategies for market entry and expansion:

• China (6.8% CAGR): Dominates global production, fueled by its EV industry and government incentives supporting eco-friendly leathers.

• India (6.3% CAGR): Rising passenger vehicle sales and investment in sustainable tanning technologies boost demand.

• Indonesia (6.0% CAGR): Incentives for automotive growth and adoption of cost-effective synthetic leathers expand market penetration.

• Vietnam (5.9% CAGR): Rising vehicle ownership and aftermarket refurbishment enhance opportunities.

• Germany (5.8% CAGR): Luxury vehicle hub emphasizing sustainable innovation and biodegradable leathers.

• USA (5.4% CAGR): Demand anchored by luxury vehicles, EV adoption, and aftermarket customization.

• Brazil (5.2% CAGR): Expanding automotive hubs and growing exports reinforce demand for synthetic alternatives.

Manufacturers Adapting to New Realities

Leading companies such as Lear Corporation, Seiren Co., Ltd., GST AutoLeather Inc. (Pangea), BOXMARK Leather GmbH & Co KG, and Bader GmbH & Co. KG are scaling production while embracing eco-friendly materials and antimicrobial innovations. Their pipelines focus on sustainability, durability, and compliance with evolving regulations, strengthening partnerships with OEMs worldwide.

At the same time, regional players are upgrading production technologies to compete on cost efficiency and sustainable practices. Collaboration across global and local supply chains ensures stable sourcing of raw materials, compliance with environmental standards, and reliable distribution.

Key Opportunities for Industry Stakeholders

For manufacturers, the next decade presents opportunities to capitalize on:

• Scaling PU Leather Production: Meeting surging demand for durable, versatile, and affordable alternatives to genuine leather.

• Expanding Aftermarket Offerings: Catering to growing customization trends with eco-friendly, diverse, and affordable materials.

• Investing in Sustainable Innovation: Developing bio-based, recyclable, and antimicrobial leathers to meet evolving consumer and regulatory expectations.

• Targeting High-Growth Regions: Aligning strategies with regional dynamics in Asia Pacific, particularly in China, India, and Southeast Asia.

Competitive Landscape and Future Outlook

The competitive environment is shaped by innovation pipelines and sustainability benchmarks. Companies that integrate eco-friendly processes, advanced coatings, and durable performance features will strengthen their competitive edge. As automotive OEMs and aftermarket suppliers increasingly prioritize sustainable sourcing and consumer-driven comfort, suppliers with diverse portfolios and compliance credentials will see long-term growth.

By 2035, the automotive interior leather market will not only represent a USD 39.2 billion opportunity but will also redefine the industry’s approach to sustainability, customization, and next-generation vehicle interiors. Manufacturers that embrace this transformation will position themselves at the center of growth, supplying materials that combine luxury, durability, and environmental responsibility.

Request Automotive Interior Leather Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-1561

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us

This in-depth analysis of the automotive interior leather market (2025–2035) highlights material trends, regional outlooks, and strategic opportunities for manufacturers. With insights on sustainability, aftermarket growth, and innovation in PU and synthetic leathers, the report equips industry leaders to navigate evolving consumer demands and achieve long-term competitive advantage.

Explore Related Insights

USA Automotive and Aircraft Interior Genuine Leather After Market:

https://www.futuremarketinsights.com/reports/us-automotive-and-aircraft-interior-genuine-leather-aftermarket

Korea Automotive Interior Leather Industry:

https://www.futuremarketinsights.com/reports/automotive-interior-leather-industry-analysis-in-korea

Automotive Valves Market:

https://www.futuremarketinsights.com/reports/automotive-valves-market

Automotive Spark Plug Market:

https://www.futuremarketinsights.com/reports/automotive-spark-plug-market

Automotive Coolant Market:

https://www.futuremarketinsights.com/reports/automotive-coolant-market

Editor’s Note:

This press release is based exclusively on verified market data and industry insights covering the automotive interior leather market from 2025 to 2035. It highlights key trends, growth drivers, investment opportunities, and competitive strategies relevant to manufacturers, suppliers, and stakeholders.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.