Humic and Fulvic Acid Based Biostimulants Market to Grow USD 2026.7 Million by 2035, Driving Sustainable Farming Growth

The USA humic & fulvic acid market will grow at a 6.7% CAGR from 2025 to 2035, driven by organic farming, specialty crops, and advanced liquid formulations.

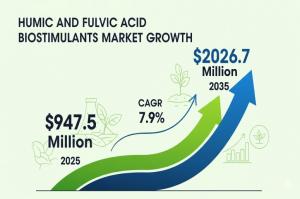

NEWARK, DE, UNITED STATES, September 3, 2025 /EINPresswire.com/ -- The global agricultural landscape is on the brink of a major transformation as the Humic and Fulvic Acid Based Biostimulants Market prepares for a decade of accelerated growth. Valued at USD 947.5 million in 2025, the market is forecasted to more than double, reaching USD 2,026.7 million by 2035, supported by a robust 7.9% CAGR. This expansion underscores the increasing demand for eco-friendly crop inputs that not only improve yields but also restore soil health, aligning perfectly with the global shift toward sustainable farming practices.

A Market Driven by Sustainability and Innovation

The agricultural inputs industry is witnessing unprecedented demand for humic and fulvic acid-based solutions. These biostimulants, derived from natural organic matter, are now recognized as vital tools for enhancing soil fertility, water retention, and nutrient absorption. Together, they represent nearly 35–38% of the overall biostimulants category, cementing their status as a cornerstone of sustainable agriculture.

Between 2020 and 2025, the industry is projected to add USD 299.7 million in market value, largely fueled by early adoption in organic and conventional farming systems. The momentum strengthens further between 2025 and 2035, with USD 1,079.2 million in additional growth, highlighting the back-weighted nature of expansion driven by rapid adoption in emerging economies and breakthroughs in product innovation.

Rising Adoption Across Key Applications

Among application methods, foliar spraying is set to lead with a 33% share in 2025, favored for its speed and efficiency in delivering nutrients directly to plant tissues. This practice allows farmers to quickly address deficiencies during crucial growth phases, improving resilience to drought, salinity, and temperature fluctuations.

By crop type, cereals and grains will dominate with a 40% share, reflecting their global importance for food security. Biostimulant adoption in wheat, maize, and rice cultivation is growing rapidly as farmers prioritize yield optimization and nutrient efficiency in the face of shrinking arable land. High-value crops such as fruits, vegetables, and horticulture also present strong opportunities, especially for export-driven economies where residue-free standards are critical.

Key Regional Growth Hotspots

The market’s global footprint is expanding, but certain regions stand out:

• China (CAGR 10.7%) – Government-backed soil health initiatives and high-value crop cultivation are propelling rapid adoption. Local manufacturers are scaling affordable liquid and granular formulations, while international players leverage partnerships and advanced technologies.

• India (CAGR 9.9%) – Organic farming incentives, agri-tech platforms, and expanding protected cultivation drive uptake across cash crops and horticulture.

• France (CAGR 8.3%) – Strong EU environmental policies and premium vineyard markets fuel growth, with local manufacturers innovating in high-purity formulations.

• UK (CAGR 7.5%) – Greenhouse farming and compliance-driven agriculture are creating demand for biostimulants as residue-free farming gains momentum.

• USA (CAGR 6.7%) – Steady growth is anchored in regenerative agriculture and specialty crop markets, supported by innovations in liquid and soluble formulations for mechanized application.

Competitive Landscape: Established Leaders and Emerging Innovators

The competitive environment is dynamic, with global leaders and new entrants alike vying for market share. Companies are innovating not only in formulations but also in distribution strategies, ensuring accessibility to both large-scale farms and smallholder growers.

• UPL Ltd leverages its global crop protection expertise to integrate humic solutions into comprehensive soil health programs.

• Humintech GmbH distinguishes itself with premium-grade extracts targeting certified organic farming and high-value crops.

• Biolchim S.p.A. pioneers advanced liquid formulations tailored for specialty nutrition in horticulture.

• AgriLife focuses on affordable bio-based inputs, making biostimulants accessible to cost-sensitive farmers.

• Valagro, now part of Syngenta, invests in R&D to deliver climate-smart solutions integrated with precision agriculture tools.

• Haifa Group combines its strength in water-soluble fertilizers with humic formulations optimized for fertigation systems.

Emerging regional players are equally vital to the industry’s future. In Asia, startups are creating concentrated, cost-effective formulations for smallholder farmers, while in Europe, niche firms are innovating in nano-carrier technologies to improve delivery efficiency. These developments signal that both established giants and agile newcomers are shaping the market’s future.

Why Demand is Accelerating

Several forces are driving this unprecedented momentum:

1. Soil Health Restoration – Farmers facing declining organic matter and nutrient-depleted soils are adopting humic and fulvic acids to revitalize productivity.

2. Organic & Residue-Free Farming – Global consumer demand for chemical-free produce aligns with these natural formulations, which also meet certification standards.

3. High-Value Crop Cultivation – Fruits, vegetables, and horticulture crops demand consistent nutrient efficiency and stress resilience, making biostimulants indispensable.

4. Technological Innovation – Advances in soluble and liquid formulations, nano-delivery systems, and compatibility with precision farming enhance application efficiency.

5. Supportive Regulations – Policies in Europe, North America, and Asia-Pacific increasingly encourage natural farming inputs, accelerating adoption.

Request Humic and Fulvic Acid Based Biostimulants Market Draft Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-23129

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Market Challenges and Pathways to Growth

Despite strong prospects, barriers remain. Product standardization is a persistent challenge, as variability in raw material sources impacts consistency. Higher upfront costs compared to synthetic alternatives deter some farmers, particularly in cost-sensitive regions. Additionally, limited awareness among small and marginal farmers restricts penetration.

To address these challenges, manufacturers are:

• Developing concentrated, affordable formulations.

• Expanding farmer education and awareness campaigns.

• Partnering with cooperatives and agri-tech platforms to broaden access.

• Streamlining supply chains to ensure reliability and efficiency.

Related Insights from Future Market Insights (FMI)

Acid Dyes Market - https://www.futuremarketinsights.com/reports/acid-dyes-market

Acid Chlorides Market - https://www.futuremarketinsights.com/reports/acid-chlorides-market

Biostimulants Market - https://www.futuremarketinsights.com/reports/biostimulants-market

Editor’s Note:

The humic and fulvic acid-based biostimulants market is gaining traction as farmers seek sustainable ways to boost crop productivity and soil health. With rising global demand for organic farming solutions, these biostimulants are becoming integral to modern agriculture. This report highlights market growth, key innovations, and opportunities shaping the industry’s future.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.